Record year of delivery

Mitie delivered a record performance and further strategic progress in the year ended 31 March 2024. In this final year of our previous Three-Year Plan (FY22 – FY24), we have demonstrated a strong track record of achievement, having met or significantly exceeded all of our medium-term targets. Our new Three-Year Plan (FY25 – FY27) pivots the business from traditional Facilities Management to technology-led Facilities Transformation, with ambitious targets to accelerate growth and enhance shareholder returns.

Financial highlights

Revenue, including share of JVs and associates

+11%

FY23: £4,055m

Operating profit before other items 1 2

+30%

FY23: £162m

Basic earnings per share before other items 1

+29%

FY23: 9.5p

Dividend per share

+38%

FY23: 2.9p

Group revenue

+13%

FY23: £3,945m

Operating profit 2

+42%

FY23: £117m

Free cash flow

+£92m

FY23: £66m

Average daily net debt

+£77m

FY23: £84m

1. Other items are as described in Note 4 to the consolidated financial statements.

2. Operating profit includes share of profit after tax from joint ventures and associates.

Chief Executive’s review

We are pleased with our strong performance in FY24, having delivered record revenue, operating margin expansion and a good return on invested capital. Mitie is a cash generative business with a robust balance sheet, and we are committed to investing in accelerated growth, as well as returning surplus funds to shareholders via share buybacks.

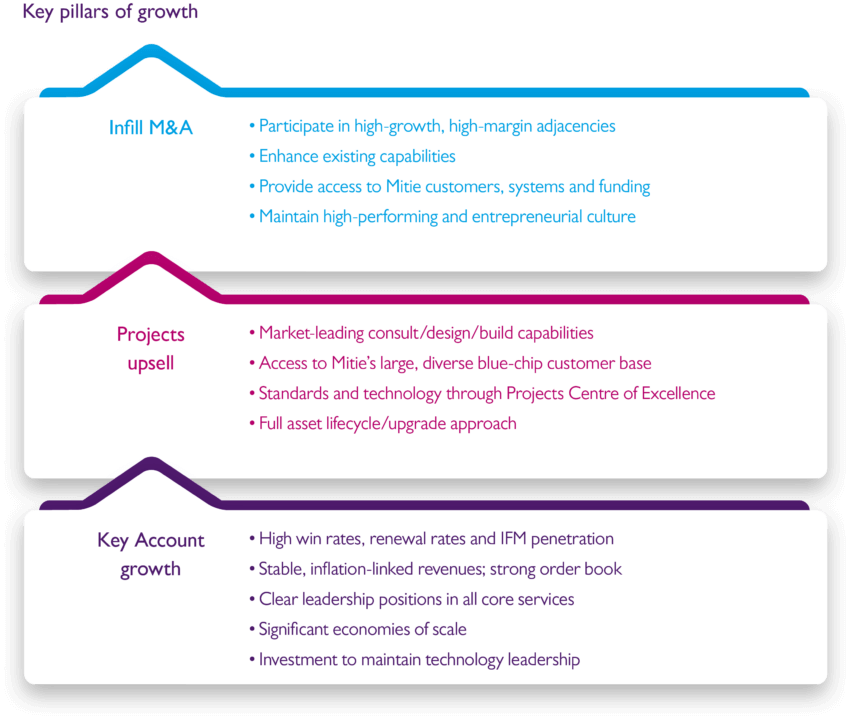

Our strategy and targets

Our new Three-Year Plan (FY25 – FY27) pivots the business from traditional Facilities Management to technology-driven Facilities Transformation. Mitie is the market leader in the UK, with deep capabilities to aggregate workflow and workforce data across the built environment, and a trusted partner to thousands of blue-chip public and private sector organisations. We have advanced our core capabilities through targeted investments in technology and strategic M&A, alongside the work of our exceptional colleagues, to meet the changing needs of our customers.

Our customers are looking for asset optimisation, a reduced carbon footprint and higher levels of assurance for security and cleanliness, whilst embracing hybrid-working and creating a ‘Great Place to Work’. This all requires cyber-secure data driven insights to inform better decision-making.

These needs for transformation are underpinned by attractive macro trends, including decarbonisation, the modernisation of the built environment, and changes in legislation and the regulatory landscape, that benefit both our core service lines and Projects business.

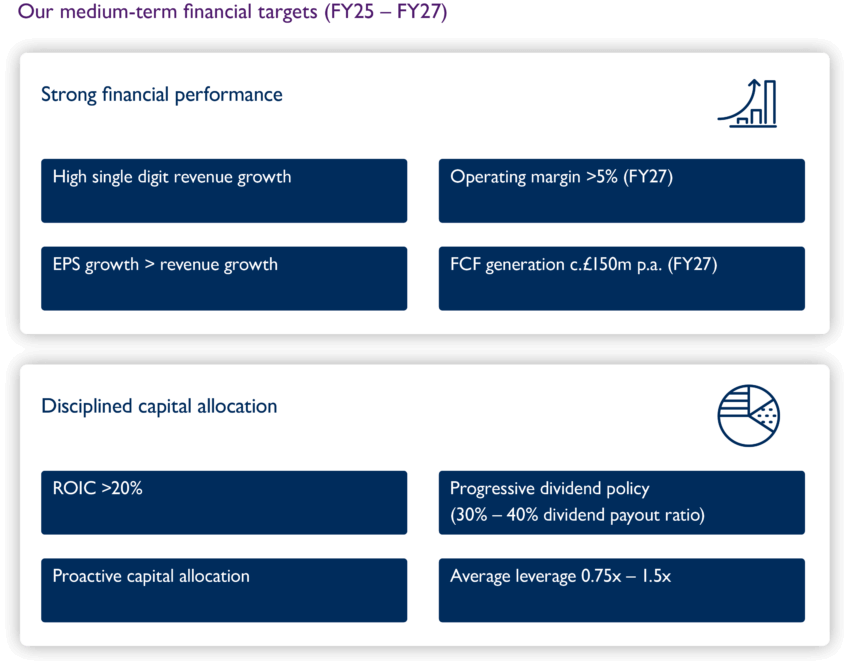

Our ambitious financial targets (based on alternative performance measures) for our new Facilities Transformation Three-Year Plan are set out below and are designed to deliver enhanced shareholder returns over the period.

- High single digit revenue compound annual growth rate

- 5% operating margin by FY27

- EBITDA >£300m by FY27

- EPS growth above that of revenue growth, despite higher corporation tax rates

- £150m annual free cash flow by FY27

Skip to content

Skip to content